Of all the metrics used by investors to understand the trajectory a company might be on, growth in both sales and earnings-per-share are among the most important.

These measures are a natural starting point when it comes to studying company growth. But they’re also useful in other areas, such as stock valuation. For that reason, you find them in strategies across a whole spectrum of investing styles, including value, momentum, yield and growth.

While most of us take an interest in company income, it’s growth investors that really prioritise positive changes in sales and earnings. That’s because comparing growth over different timeframes (including what might be expected in the future) can help track down some of the most exciting and fastest growing companies in the market.

In this article we’re going to look at why sales and earnings are important and how you can use them to find fast growing companies.

Understanding what sales and earnings really are

On a company income statement, sales are the top line and earnings are the bottom line. Most of what sits in between are expenses, taxes and accounting adjustments.

Sales is a term that’s interchangeable with revenue and turnover - and without it there can usually be no earnings.

Part of the reason why sales are taken seriously in growth strategies is that it’s a measure that is hard to manipulate. All things being equal (and legal), sales figures are metrics that management can’t easily dress up. So any investor looking for strong and accelerating earnings over time will want to see that sales are growing too.

In some cases - where a company is yet to generate earnings - sales might be the only obvious clue to growth. In the dotcom boom in the late 1990s, the price-to-sales ratio became a popular way of valuing companies with no earnings (and in many cases no chance of generating any). Understandably, the P/S ratio fell out of favour after that, but today sales and the P/S ratio are still very important measures.

Ultimately, however, most investors want to see sales lead to a positive bottom line - and that means positive earnings. Earnings is essentially a byword for profits. It captures what the company makes in sales minus all the associated costs that come later on. What’s left is attributable to common shareholders, and companies will retain or reinvest those profits or pay them out in dividends.

On its own, earnings gives you a snapshot of a company’s profitability. But to compare earnings over time or between different companies, a more useful measure is earnings-per-share (EPS). EPS takes a company’s earnings figure and divides it by the number of shares it has in issue.

Like many financial metrics, EPS isn’t perfect. It doesn’t really tell you about the ‘efficiency’ of a company’s profitability, and it can also be ‘gamed’ or distorted by events like share buybacks. But nonetheless, it is ubiquitous in stock analysis. It provides a picture of growth (or contraction) over time and is also an important component in valuation.

The price-to-earnings ratio, for example (which compares the price per share with the earnings per share), tells you how many years of earnings it will take to repay your investment at the current price. Generally speaking, the higher the number, the more expensive the stock.

Another measure, the price to earnings growth ratio (PEG ratio) is used by growth investors who have one eye on value. The PEG measures the trade-off between a company’s share price, its earnings, and its expected EPS growth rate. Generally, a lower PEG (below 1) indicates better value, because it means paying less for each unit of earnings growth.

How to use sales and earnings to find fast growth

According to some of the most influential growth investors, earnings are a crucial early consideration, especially when growth rates are compared over time. These measures are found in many strategies but a couple of the best known are those used by well known figures like Mark Minervini and William O’Neil.

In his book, How to Make Money in Stocks, O’Neil described the percentage change in EPS as “the single most important element in stock selection today. The greater the percentage increase, the better.”

In O’Neil’s CAN-SLIM checklist, the C and A stand for Current and Annual earnings and sales growth. Similarly, Minervini initially filters the market based on fundamentals including fast and accelerating earnings growth in recent quarters.

Generally, these strategies look for double-digit growth in recent years and then for signs of acceleration. That means looking at how the most recent quarter EPS compares against the same quarter last year, and then whether the EPS is growing quarter-on-quarter.

In essence, this approach looks for earnings that are snowballing. Often there will be other variables to take into account. Some strategies look at catalysts, institutional demand for shares and growing trading volumes. Likewise, tome growth investors will be wary of overpaying and will take valuation seriously - but others (like O’Neil and Minervini) are less concerned about price and more interested in chart setups.

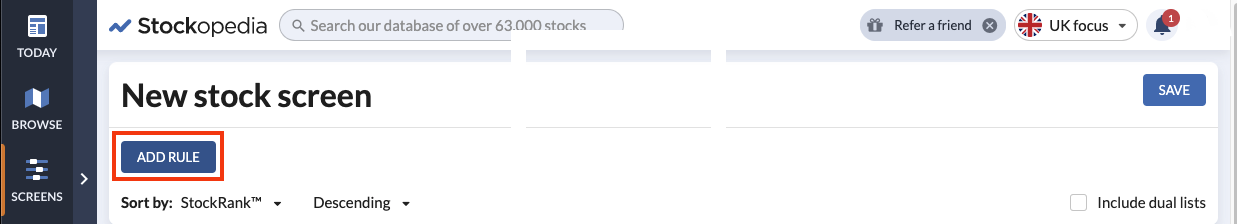

To apply some of these ideas with the Stockopedia Screener, go to Screens and click to create a new screen:

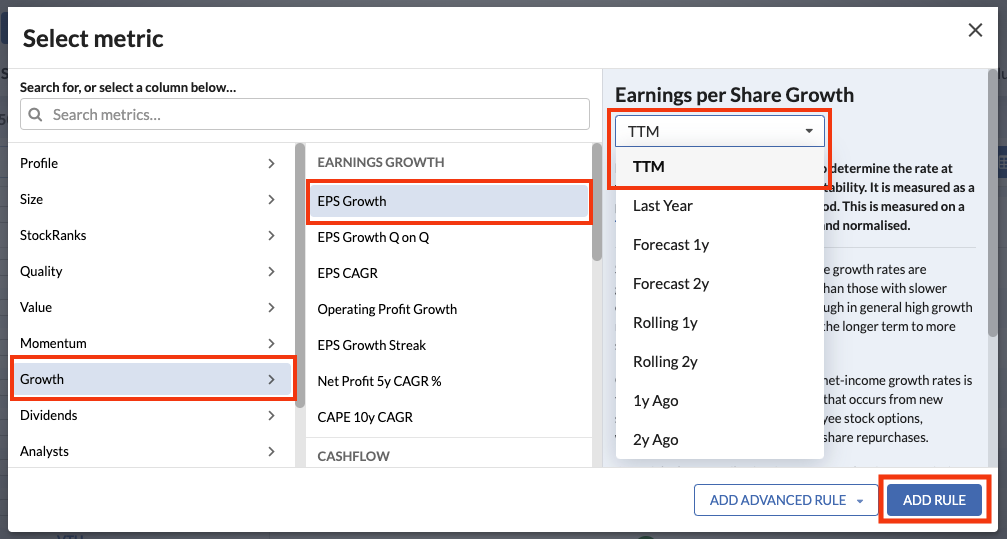

Clicking “Add Rule” will launch the ratio picker. From there, you can select Growth > EPS Growth and then select the timeframe you want to use. In this case, the TTM timeframe will measure growth over the previous four financial quarters (including interims).

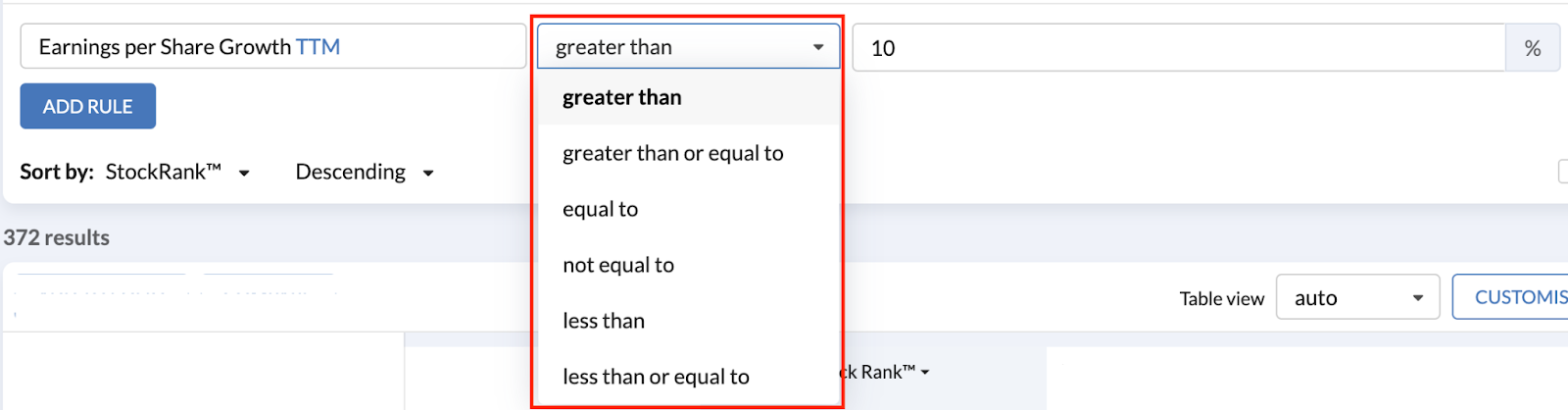

After adding that rule, you’ll be able to specify how you want to use it (in this case “greater than”) and by what measure (in this case ‘10%’). So this rule will filter the market for companies with EPS growth over the previous four reported financial quarters of more than 10%.

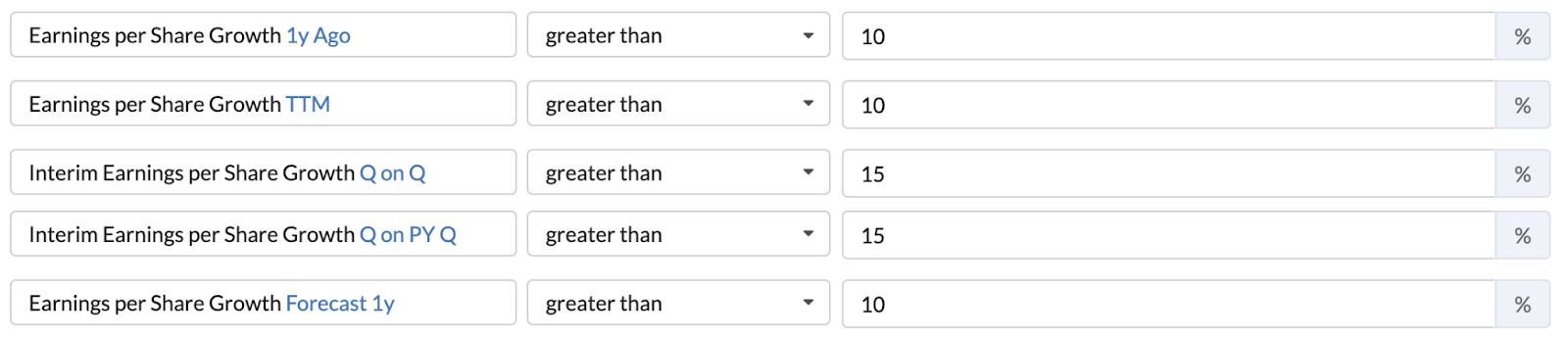

Returning to the ratio picker, this screen uses additional EPS Growth rules over different time frames, including the 1-year Forecast, to look for consistent and accelerating earnings growth.

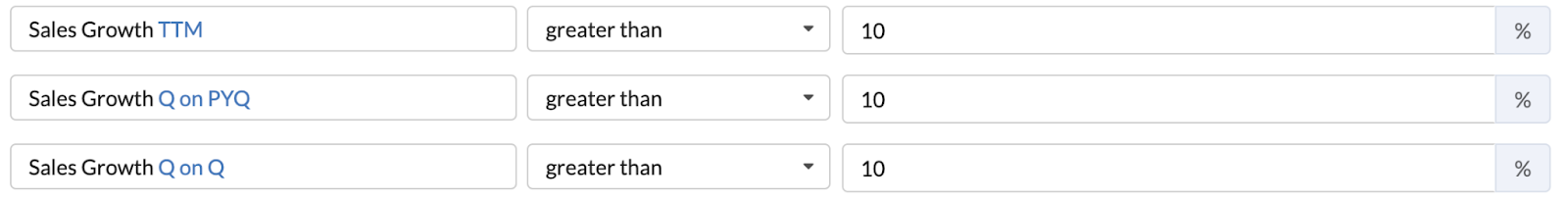

To avoid companies that might be manipulating their earnings somehow, it also uses some sales growth rules. These take a similar approach to the earnings growth rule, and should give some added confidence that stocks with fast growing earnings have strong sales growth backing them up.

The results produce a screen list that looks like this (these are just the top results):

Growth means different things to different investors of course, but sales and earnings are fundamental components of many strategies. By just using these measures, it's possible to get quickly find companies that are genuinely growing quickly - and make the rules very demanding. These types of screening criteria can be a useful check in any strategy, but they are a foundation in some of the most popular growth strategies. You can find this Fast EPS and Sales Growth screen here

It’s worth noting that fast growing companies can quickly capture the imagination of the market and their valuations can soar. Some growth investors are more concerned about this than others - but either way, it’s worth being cautious. There are rarely any guarantees that an accelerating growth record will continue, but in the hunt for ideas, studying sales and EPS growth over time can be an effective way of tracking down the fastest moving companies.

Disclaimer - This is not financial advice. Our content is intended to be used and must be used for information and education purposes only. Please read our disclaimer and terms and conditions to understand our obligations.

As an enthusiast deeply immersed in the world of investing, particularly in the analysis of company growth through sales and earnings metrics, I bring a wealth of knowledge and practical experience to this discussion. I've been actively involved in analyzing financial markets and have a proven track record of understanding the intricacies of sales, earnings, and their impact on investment strategies.

Now, let's delve into the concepts discussed in the article about the significance of sales and earnings in evaluating a company's growth trajectory.

Sales, often used interchangeably with revenue and turnover, represent the top line of a company's income statement. One compelling point made in the article is the difficulty in manipulating sales figures, making them a reliable metric for investors. Robust and accelerating earnings are typically associated with growing sales, making it a key focus for those seeking promising investment opportunities.

Earnings, the bottom line on an income statement, are essentially profits derived from subtracting all associated costs from sales. The article emphasizes that positive earnings are a crucial factor for investors, as they indicate the profitability of a company. To compare earnings over time or between different companies, the article introduces the concept of earnings-per-share (EPS), calculated by dividing a company's earnings by its number of shares. While EPS has its limitations, it is widely used in stock analysis and provides insights into growth or contraction over time.

The article also introduces various valuation metrics associated with earnings, such as the price-to-earnings ratio (P/E ratio) and the price to earnings growth ratio (PEG ratio). The P/E ratio helps investors assess how expensive a stock is relative to its earnings, while the PEG ratio incorporates the expected EPS growth rate, providing a more comprehensive measure of value.

To find fast-growing companies, the article suggests strategies employed by influential growth investors like Mark Minervini and William O’Neil. These strategies involve looking for double-digit growth in recent years and signs of acceleration, often by analyzing the percentage change in EPS. The CAN-SLIM checklist mentioned in the article focuses on current and annual earnings and sales growth as essential criteria.

The article concludes with a practical example of using the Stockopedia Screener to filter companies based on EPS growth over specific time frames, reinforcing the importance of consistent and accelerating earnings growth in investment strategies.

In summary, the article highlights the fundamental role of sales and earnings in evaluating company growth, providing valuable insights for investors looking to identify fast-growing opportunities. It underscores the importance of employing comprehensive screening criteria to navigate the dynamic landscape of the stock market.